flow through entity canada

It is considered a separate entity for legal purposes in the US and Canada. 2 days agoEach FT Unit will consist of one flow-through Common Share a FT Share that will qualify as a flow-through share within the meaning of subsection 6615 of the Income Tax Act Canada the.

Content Metamodel Enterprise Architecture Business Architecture Technology Infrastructure

The typical examples of these entities are US Limited Liability Company LLC Limited Liability Partnership LLP or Limited Liability Limited Partnerships LLLP.

. The corporation will have to submit the form as soon as the information becomes available along with a copy of the following documents where applicable. A foreign simple or foreign grantor trust other than a withholding foreign trust If the Chapter 3 payee is a disregarded entity or flow-through entity for US. Much like RRSPs Flow-Through share investing allows the investor to deduct 100 of the investment against personal income in the year of investment.

Tax purposes but the payee is claiming treaty benefits see. This article does not deal. Nathan Boidman Cross-Border Investment in and Acquisitions of Public Flow-Through Entities.

A related segregated fund trust. The Government of Canada defines Flow-Through Shares in the following way. The flow-through share entered the Canadian tax code just over 25 years ago.

A limited partnership LP is a flow-through entity in both Canada and the US so it does not have the same problems as the LLC. 5 In general an FTE may elect to pay tax on certain income at the individual income tax rate. Investments in the trust are listed or traded on a stock exchange or other public market.

All of the following are flow-through entities. 1 2021 contingent upon the existence of the TCJA SALT deduction limitation the legislation creates an elective tax on FTEs with business activity in Michigan. The basic principle behind flow-through shares which are unique to the resource sector in Canada is that a mining corporation willing to forego the tax benefit of certain CEE and CDE amounts that it incurs can renounce.

A mortgage investment corporation. Flow-Through Share Tax Savings Calculator One of the few remaining advanced tax planning strategies in Canada. For Canadian income tax purposes ULCs are treated as regular corporations subject to Canadian tax on their worldwide income.

Flow-through shares FTSs On July 10 2020 the Government of Canada announced changes to protect jobs and safe operations of junior mining exploration and other flow-through share issuers by extending the timelines for spending the capital they raise via flow-through shares by 12 months. On December 16 2020 the Department of Finance published the. Relevance arose from the confluence of two factors.

Flow through entity canada. We have previously published a high-level overview of the taxation of US LLCs in Canada. For Canadian income tax purposes ULCs are considered corporations and are subject to Canadian income taxation.

Topaz is a unique royalty and infrastructure energy company focused on generating FCF 1 growth and paying reliable and sustainable dividends to its shareholders through its strategic. The conversion is generally tax neutral in the US but taxable in Canada. Canadas quirky tax innovation.

Flow-through shares FTS can provide mining companies with reduced-cost access to financing in this situation. Flow-through entity tax For tax years beginning on and after Jan. Canada Tax Notes International Volume 39 No.

However for US tax purposes ULCs may be considered flow-through entities ie the ULC is disregarded and the earnings of the ULC are flowed through to the ultimate owners of the ULC. The Advantages of an S Corporation in Canada. Flow-through entities include sole proprietorships partnerships limited liability partnerships LLCs and S corporations.

T100B - Details of the flow-through shares FTSs and flow-through warrants FTWs subscribed. A mutual fund corporation. Flow Through Entities Owned by Residents of Canada.

General flow-through income for Canadian tax purposes and avoid entity-level tax. A trust governed by an employees profit sharing plan. Downsides to Flow-Through Entities There is a criticism on the flow-through entity this resulted from one of its drawbacks in which owners of entities are taxed on the income not directly receive by them but by the entity.

In Canada however investment corporations whether mortgage trust mutual fund or partnership are regarded as flow-through entities. A mutual fund trust. Reserve all the benefits of an S-Corp on US earned income.

A foreign partnership other than a withholding foreign partnership. Due to the ease of establishment. The information in this section also applies if for the 1994 tax year you filed Form T664 Election to Report a Capital Gain on Property Owned at the End.

A hybrid entity is an entity that has different tax treatments in different countries. A specified investment flow-through SIFT trust is one other than a real estate investment trust for a tax year or an excluded subsidiary entity that meets all of the following conditions at any time during a tax year. Form T100B is for the disclosure of the subscribers and the actual amounts subscribed.

Is not subject to double taxation or corporate tax rates in the US. It is considered a flow through entity for tax purposes in the US. Looking back mining executives lawyers bankers and accountants believe this.

On termination of the Flow-Through LP the investment is rolled into a designated mutual fund. You are a member of or investor in a flow-through entity if you own shares or units of or an interest in one of the following. This post is an attempt to further.

Flow through entity canada. 6 August 8 2005 p. However for US tax purposes ULCs may be treated either as partnerships or check-the-box flow-through entities possibly offering cross-border opportunities.

6 Members of the entity making the. Flow-through entities include sole proprietorships partnerships limited liability partnerships LLCs and S corporations. Flow-through shares have generated billions for mining exploration and contributed to the development of some of the countrys most notable mines.

The trust is resident in Canada. The information in this section also applies if for the 1994 tax year you filed Form T664 Election to. This section provides information on the types of investments that are considered flow-through entities and how to calculate the capital gain and loss resulting from the disposition of shares of or interests in a flow-through entity.

See also Boidman Note 5. In the United States certain business entities such as Limited Liability Companies LLC or subchapter S corporations are flow through entities where the entity does not pay tax but where the net income and other tax results flow through to the members or shareholders on a pro rata basis.

Ferguson Business Associations Flowcharts Spring 2009 Law School Life Law School Survival Law Notes

The Rise And Fall Of Canadian Income Trusts Tax Canada

24 Best Canadian Reit Stocks 2022 Invest In Real Estate

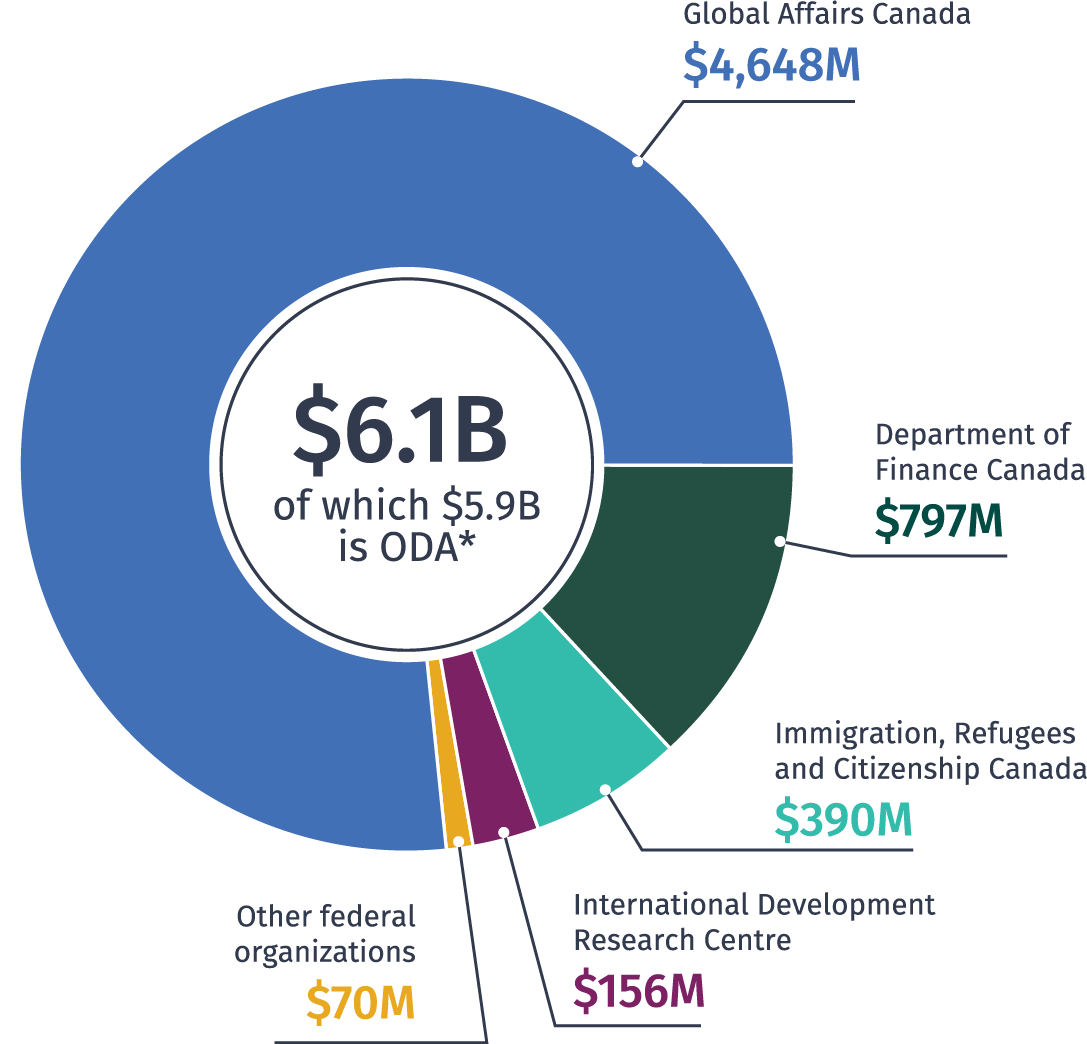

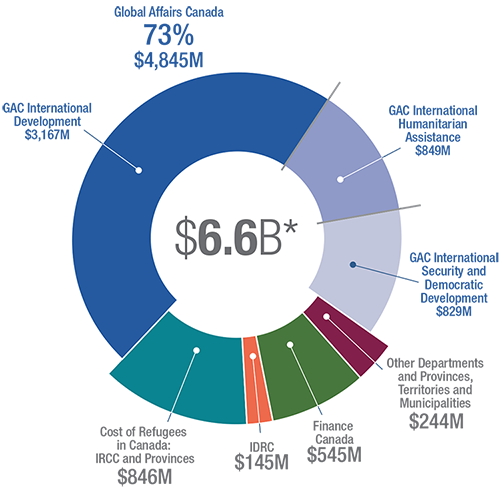

Report To Parliament On The Government Of Canada S International Assistance 2018 2019

Statistical Report On International Assistance 2018 2019

Why Do Llcs Result In Double Taxation For Canadians Madan Ca

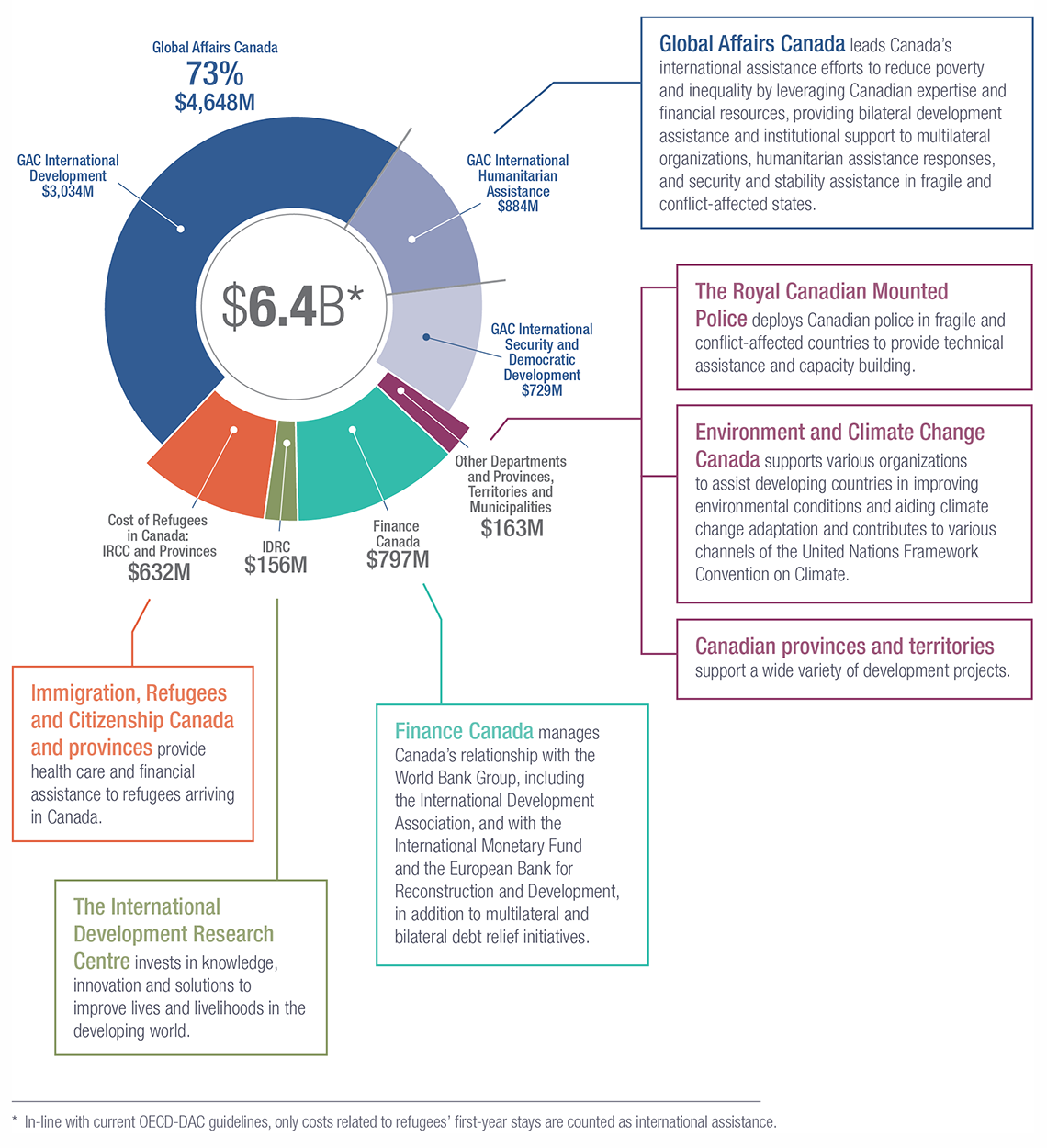

Report 1 Procuring Complex Information Technology Solutions

Limited Liability Partnership Llp Partnership Structure Kalfa Law

The Canadian Women S Heart Health Alliance Atlas On The Epidemiology Diagnosis And Management Of Cardiovascular Disease In Women Chapter 5 Sex And Gender Unique Manifestations Of Cardiovascular Disease Cjc Open

Canada Health Act Annual Report 2020 2021 Canada Ca

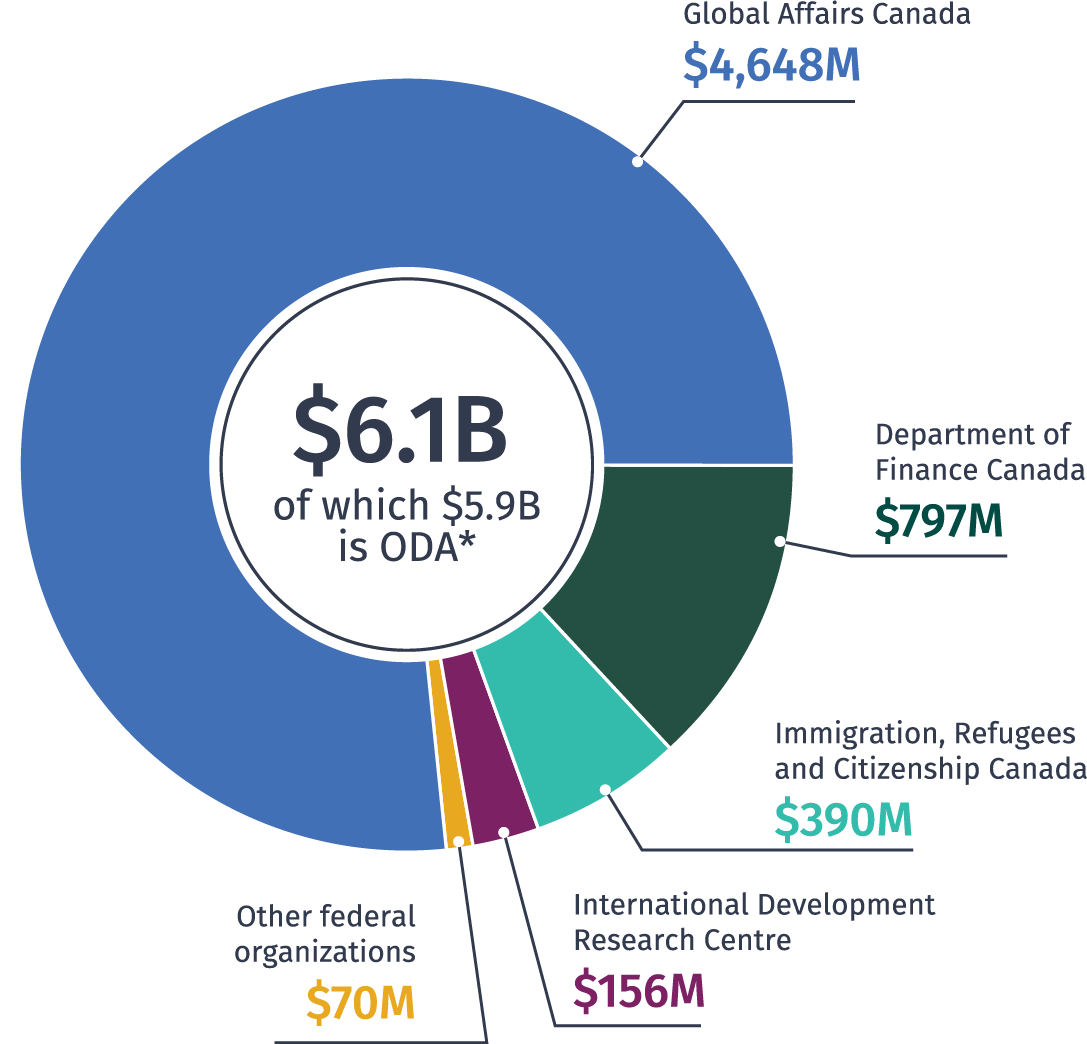

Statistical Report On International Assistance 2019 2020

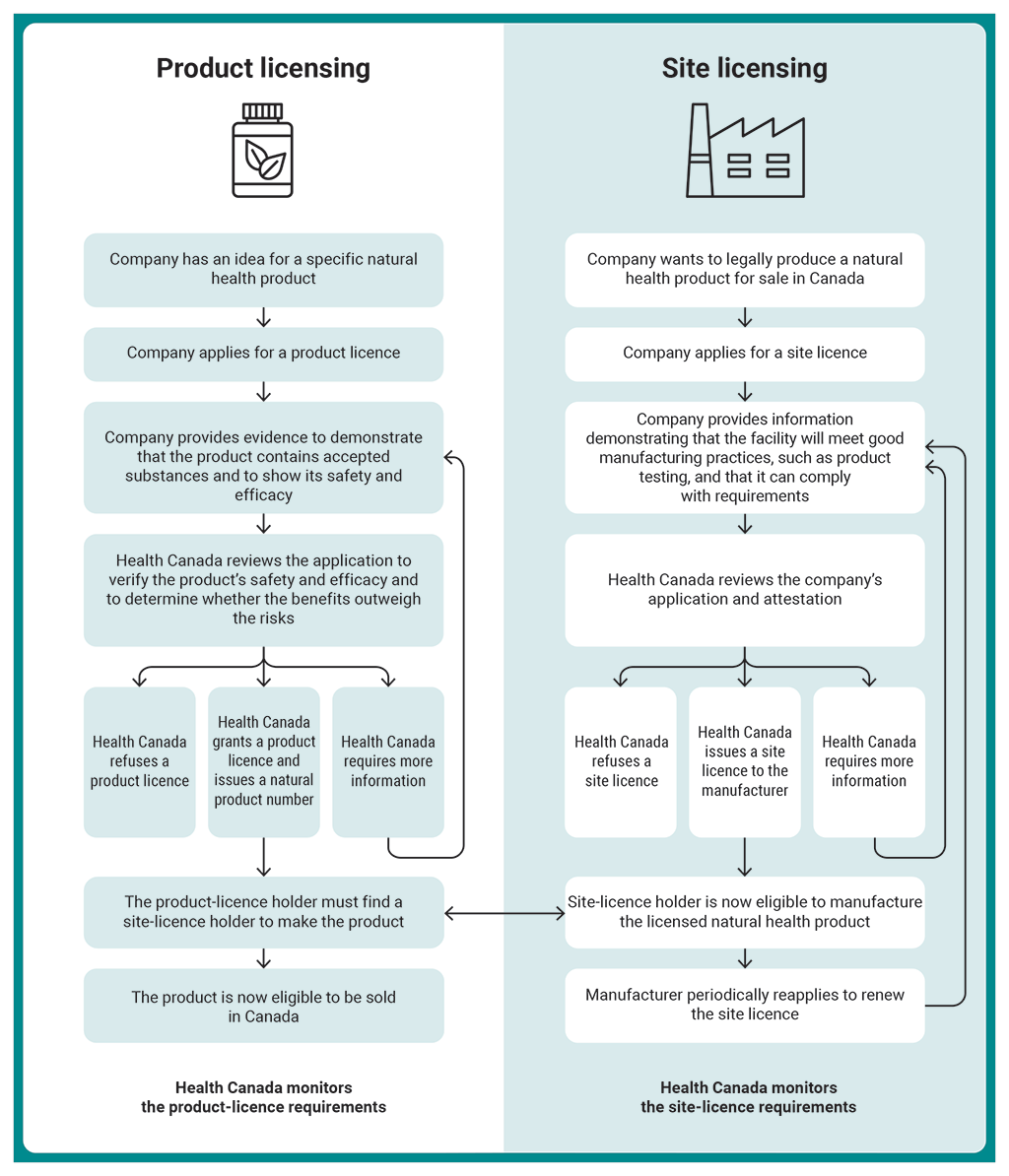

Report 2 Natural Health Products Health Canada

Master Service Agreement Template Cash Flow Statement Agreement Templates

Pin By Valerie W On Starlight Star Bright Ley Lines Earth Grid Alien Aesthetic

Section 3 Introduction To The Canada Revenue Agency Cra Canada Ca

The Ultimate Canada Crypto Tax Guide 2022 Koinly

Visualisation Of The Ocean Economy Human Impact Infographic Ocean Economy Global Economy Infographic Economy Infographic